capital gains tax canada calculator

A Canada Capital Gains Tax Calculator formula that will allow you to manually crunch numbers and get your rate. Your sale price 3950- your ACB 13002650.

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

You realize a capital gain if you sell a capital asset and the proceeds of the sale exceed the adjusted cost base.

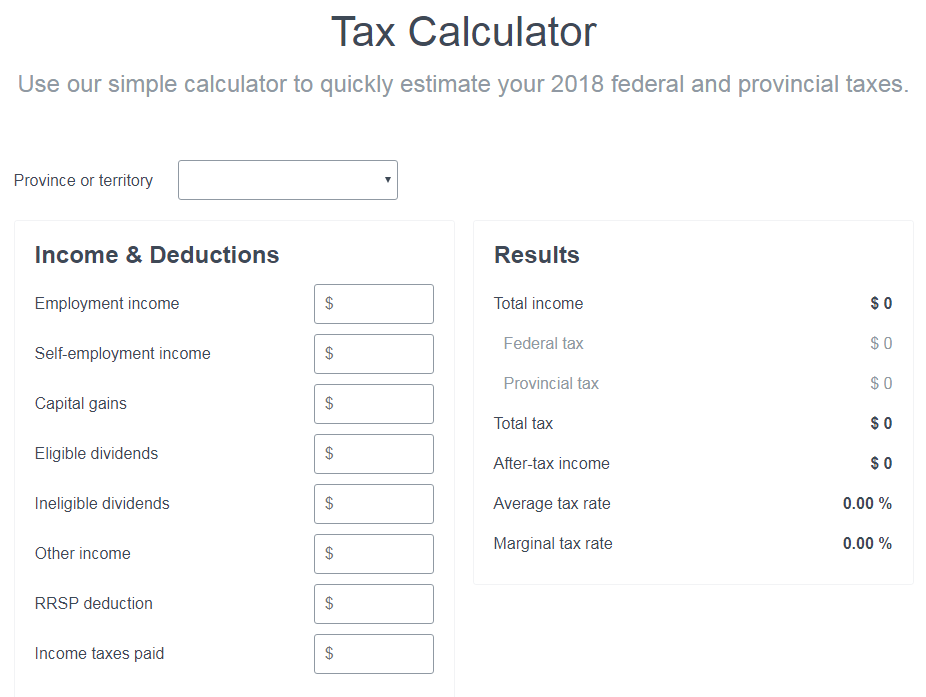

. Learn more with our team of experts today. Use Schedule 3 Capital Gains or Losses to calculate and report your taxable capital gains or net capital loss. If your only capital gains or losses are those shown on information slips T3.

2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. At Wefin we provide a multitude of financial tools including our Capital Gains Tax Canada Calculator. Completing your tax return.

For instance if you sell a. Mario calculates his capital gain as follows. Instead capital gains are taxed at your personal income tax rate.

Do not include any capital gains or losses in your business or. Since its more than your ACB you have a capital gain. Our calculator can be used as a long-term capital gain calculator by increasing the duration of the investment.

Capital Gains Tax in Canada. 6500 - 4000 60. With the Perch capital gains tax calculator you can easily.

On line 12700 enter the positive amount from line 19900 on your Schedule 3If the amount on line 19900 on your Schedule 3 is negative a loss do not. In Canada 50 of the value of any capital gains is taxable. Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions.

Perch Canadian Capital Gains Tax Calculator 2022 4 days ago Sep 01 2022 However the LCGE allows you to subtract 913630 from your profits in 2022 so you only pay taxes on 950000. Our calculator can be used as a long-term capital gain calculator by increasing the duration of the investment. In mathematical terms the formula is as.

The tax rate you pay on long-term capital gains can be 0 15 or 20 depending. Capital Gains - half of this amount is taxable which the calculator automatically. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

The sale price minus your ACB is the capital gain that youll need to pay tax on. Capital assets subject to this tax according to the Canada Revenue Agency include buildings land shares bonds and real. Capital assets subject to this tax include real estate land shares bonds.

Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. Adjusted cost base plus outlays and expenses on disposition. Only 50 of your capital gains are taxable.

Then to determine the amount to add to your income tax and benefit return you will multiply your capital gains by 50. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. The calculator on this page is designed to help you estimate your.

There is no special capital gains tax in Canada. Each capital gains calculator includes personal tax allowances tax deductions etc and provides a breakdown of your annual salary with Monthly Quarterly Weekly Daily and Hourly pay. You realize a capital gain when you sell a capital asset and the proceeds of disposition exceeds the adjusted cost base.

Completing your income tax return. Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022. How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province.

This means that only. The tax rate you pay on long-term.

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Reporting Capital Gains Dividend Income Is Complex Morningstar

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Capital Gains Tax What It Is How It Works Seeking Alpha

Canadian Tax Brackets Marginal Tax Vs Average Tax Retire Happy

Capital Gains Tax Cgt Calculator For Australian Investors

How It Works Capital Gains Tax On The Sale Of A Property Moneysense

Capital Gains Tax Basics Tax 101 Youtube

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

Selling Stock How Capital Gains Are Taxed The Motley Fool

How Do I Report Capital Gains In British Columbia

Github Davidosborn Crypto Tax Calculator A Tool To Calculate The Capital Gains Of Cryptocurrency Assets For Canadian Taxes

Capital Gains Tax Rate Rules In Canada What You Need To Know

Capital Gain How To Calculate Short Term And Long Term Capital Gains And Tax On These The Economic Times

How To Calculate Cryptocurrency Taxes Using A Crypto Tax Calculator Zenledger

How To Calculate Capital Gains On Cryptocurrency Sdg Accountant